Filing company accounts on time is a legal requirement for all businesses registered in the UK. Companies House uses this process to maintain the public register and ensure transparency in the business environment.

With updated rules and clearer enforcement mechanisms, the 2025 Companies House late filing penalties are a critical area for business owners, directors, and accountants to understand.

Failing to comply can result in automatic fines, potential criminal action, and even removal from the register.

This guide provides a complete breakdown of the current rules, costs, deadlines, and options available to companies for appeals and extensions in 2025.

What Is A Companies House Late Filing Penalty In 2025?

A Companies House late filing penalty is a financial fine automatically issued to UK-registered companies and LLPs that fail to submit their annual accounts by the statutory deadline.

These penalties were introduced to ensure timely and accurate submission of corporate financial records to the public register.

In 2025, these penalties apply to all registered entities including private limited companies, public limited companies, and limited liability partnerships. The term “company” in this context refers to any of these entities unless explicitly stated.

Directors or designated LLP members are personally responsible for ensuring that the accounts are filed on time and in the correct format. Once the deadline passes, Companies House automatically calculates and issues the penalty.

When Are Companies Required To File Accounts With Companies House?

Filing deadlines vary depending on whether a company is submitting its first set of accounts or subsequent accounts. These deadlines are based on the company’s incorporation date and accounting reference period.

First Accounts Filing Deadlines

- Private companies and LLPs must file within 21 months of incorporation or 3 months from the accounting reference date, whichever is longer

- Public companies must file within 18 months of incorporation or 3 months from the accounting reference date, whichever is longer

Subsequent Accounts Filing Deadlines

- Private companies and LLPs are required to file accounts within 9 months after the end of their accounting reference period

- Public companies have a shorter deadline of 6 months after the accounting reference period

If a company changes its accounting reference period, the filing time may be reduced. It is important to check updated filing deadlines through the Companies House service to avoid missing crucial dates.

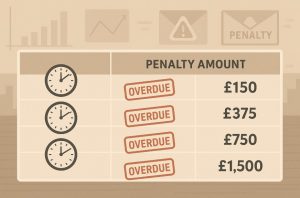

How Much Are Companies House Late Filing Penalties In 2025?

Companies House penalties are structured to reflect the severity of the delay. The longer the accounts are overdue, the higher the penalty. Public companies face steeper fines compared to private companies or LLPs.

Below is the updated penalty structure for 2025:

Companies House Late Filing Penalty Charges (2025)

| Delay Period From Deadline | Private Company / LLP | Public Company |

| Not more than 1 month | £150 | £750 |

| More than 1 month but not more than 3 months | £375 | £1,500 |

| More than 3 months but not more than 6 months | £750 | £3,000 |

| More than 6 months | £1,500 | £7,500 |

If a company files accounts late in two consecutive financial years, the penalty is automatically doubled. This is applied to financial years beginning on or after 6 April 2008 and remains active in 2025.

An example scenario: a private company with an accounting period ending on 30 September 2024 must file its accounts by 30 June 2025. If the company files on 15 July 2025, it will incur a £150 penalty.

What Happens If Accounts Are Not Filed At All?

Failure to file accounts is treated as a criminal offence. Directors and designated members may face personal fines or prosecution. The company can also be struck off the public register by the registrar.

Legal consequences may include:

- Criminal charges against directors

- Court-issued financial penalties

- Company dissolution through strike-off

- Additional civil enforcement for non-payment

Companies that ignore both their filing duties and any resulting penalties are more likely to be escalated to the court system for resolution.

How Can Companies Avoid Companies House Late Filing Penalties?

Avoiding Companies House late filing penalties is entirely possible with proper planning, awareness of deadlines, and the use of tools and resources available to companies.

Directors and LLP members hold the responsibility to ensure accounts are delivered on time and in the correct format. Below are key strategies that can help companies remain compliant.

Planning Ahead for Statutory Deadlines

The most effective way to avoid a penalty is by proactively managing deadlines. Filing dates should be tracked and planned well in advance, especially for companies with complex accounts or external accountants involved.

Best Practices:

- Determine your accounting reference date and calculate your filing deadline based on it

- Plan backward from the filing date to allow ample time for account preparation, review, and submission

- Avoid last-minute submissions, which carry a higher risk of formatting errors or missed deadlines

Using Digital Tools and Companies House Services

Companies House offers digital tools that simplify compliance and help companies track their deadlines effectively.

Recommended Tools:

- Email Reminders: Register for free email alerts from Companies House to receive advance notifications

- Companies House Online Service: Use the WebFiling service for real-time submission and instant confirmation

- Calendar Integrations: Sync key deadlines with shared team calendars to ensure accountability

By leveraging technology, directors and finance teams can significantly reduce the likelihood of missing deadlines due to oversight.

Coordinating With Accountants and Service Providers

Accountants play a vital role in preparing financial statements and ensuring they meet legal requirements. Communication and early engagement are essential.

Coordination Tips:

- Engage your accountant early, especially during the busy tax season

- Set internal deadlines for data submission and report preparation well before the official filing deadline

- Clarify roles and expectations to ensure there’s no misunderstanding about who will file and by when

A common cause of late filing penalties is the incorrect assumption that an accountant has already submitted the documents. Clear and consistent communication can prevent this issue.

Allowing Extra Time for Submission and Corrections

Companies should build in buffer time before the filing deadline. This is especially important for postal submissions or when the accounts are complex and require internal approval.

Submission Considerations:

- Aim to submit at least one week before the deadline

- If filing by post, use tracked or guaranteed delivery to confirm arrival at Companies House

- Check documents thoroughly to ensure they meet Companies House requirements, such as proper signatures and formatting

This early submission window provides room to resolve any issues if the accounts are rejected or returned for correction.

Filing Online Whenever Possible

For most limited companies, online filing is the fastest, most secure, and most reliable method. It ensures the accounts are received immediately and confirmed via email.

Benefits of Online Filing:

- Instant confirmation of delivery

- Lower likelihood of formatting or compliance issues

- Ability to correct and resubmit quickly if necessary

While LLPs may still be required to submit paper accounts, all entities that have the option to file online are strongly encouraged to do so to minimise risk.

Can Companies File Accounts Online Or Request Extensions?

Most limited companies can file accounts electronically through the Companies House WebFiling or compatible accounting software. This method offers immediate confirmation and reduces the likelihood of rejection due to format errors.

However, LLPs must generally file accounts via post or other approved channels, as online filing is not yet widely available for these entities.

Extensions For Filing Deadlines

If a company foresees that it may not be able to meet its filing deadline due to an unexpected event, it may apply for an extension. The application must be made before the deadline passes and must include valid and exceptional reasons.

Companies House will assess each case individually and will only grant an extension if the circumstances are proven to be beyond the company’s control.

Valid scenarios may include:

- Fire or natural disaster damaging records

- Serious illness affecting key personnel

- Cyberattacks or significant IT failure

Situations like being unaware of deadlines or accountant unavailability are not considered sufficient grounds for extension.

What If Incorrect Accounts Are Filed?

Companies House has strict criteria for account submission, and any deviation from the prescribed format will result in the accounts being returned. This includes documents that are unsigned, contain errors, or fail to meet legal formatting standards.

If the company files corrected accounts after the deadline, a late filing penalty still applies. There is no grace period for correction, even if the original submission was on time.

To avoid these issues, companies are advised to:

- Ensure all sections, particularly the balance sheet, are correctly signed

- Double-check that the accounts meet Companies Act requirements

- Submit early to allow time for review and corrections if needed

How Do Companies Know When A Penalty Has Been Issued?

When accounts are submitted late, Companies House automatically sends a penalty notice to the company’s registered office. This notice outlines the following information:

- The filing deadline that was missed

- The date the accounts were received

- The exact penalty amount imposed

- Instructions for paying the fine online or by other means

If the penalty is not paid, Companies House may begin enforcement action. In serious cases, this could involve debt collection agencies and court proceedings.

Can Penalties Be Paid In Instalments Or Appealed?

Companies struggling to pay the penalty in full can contact Companies House to request a short-term instalment plan. The request must include a valid reason, such as temporary cash flow issues or an unexpected financial burden.

Appealing A Penalty

An appeal will only be successful if the company can prove that exceptional circumstances prevented the accounts from being filed on time. Accepted reasons typically include:

- Natural disasters

- Severe illness

- Unforeseen technical problems during online submission

Invalid reasons include:

- Belief that dormant companies do not need to file

- Lack of familiarity with filing requirements

- Accountant error or illness

- Directors being overseas

Valid vs Invalid Appeal Reasons

| Valid Appeal Reasons | Invalid Appeal Reasons |

| Fire destroying records | Company is dormant |

| Critical illness near deadline | Accountant was late or ill |

| IT failure on submission day | Directors were travelling |

| Death of key team member | Lack of understanding of rules |

If an appeal is rejected, the company may escalate the matter to the Senior Casework Unit, and then, if necessary, to the Independent Adjudicators. However, adjudicators cannot overrule the registrar’s legal discretion to enforce the penalty.

What Are The Consequences Of Restoring A Struck-Off Company?

If a company that has been struck off the register is later restored, certain penalties may still apply depending on the timing and circumstances.

The following rules apply to restored companies:

- Penalties issued for overdue accounts before the company was dissolved must still be paid

- Penalties for overdue accounts submitted on restoration will also be charged

- No penalties will apply for the period during which the company was dissolved

Restoring a company does not eliminate prior obligations or absolve directors of accountability for previous filing failures.

Conclusion

Staying compliant with Companies House filing deadlines in 2025 is essential to avoid financial penalties, legal risks, and reputational damage. Whether you’re managing a private company, a public organisation, or an LLP, understanding the rules, deadlines, and available remedies is key.

Ensure your team is aware of key dates, make use of Companies House reminders, and always plan ahead for submission. In case of exceptional circumstances, act early to request extensions or support to minimise the risk of enforcement actions.

FAQs

What is the difference between confirmation statements and accounts filing?

Confirmation statements confirm company details like directors and shareholders, while accounts filing reports on the company’s financial performance.

Can I delay filing if my company is dormant?

No. Dormant companies must still file annual accounts on time or face penalties.

What is the quickest way to file company accounts?

Filing online through Companies House WebFiling is the fastest and most secure method.

How do I find my company’s accounting reference date?

It can be found on the Companies House register or via your incorporation documents.

Are LLPs treated the same as limited companies for penalties?

Yes, LLPs face the same penalty amounts and filing deadlines unless specified otherwise.

Is there a grace period for late filing penalties?

No. The penalty is imposed automatically the day after the deadline passes.