Selling a home that still has an outstanding mortgage is a common practice in the UK. In fact, most homeowners will sell their property while still repaying their mortgage.

However, it’s not always as straightforward as it seems, and it’s important to understand your legal, financial and logistical responsibilities before starting the process.

This guide breaks down exactly what happens when you sell a house with a mortgage, including your options, how the mortgage is settled, and key considerations to keep in mind.

Can You Sell a House With a Mortgage in the UK?

Selling a property with an outstanding mortgage is common in the UK. Whether you are upsizing, downsizing or relocating, your mortgage doesn’t have to be fully paid off before you list your home.

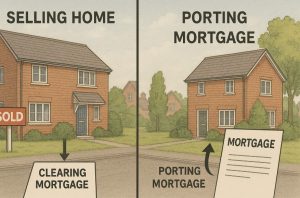

Homeowners can either repay the mortgage using the proceeds from the sale or transfer their current mortgage to a new property through a process known as porting.

Lenders generally allow this, but specific conditions often apply. You must confirm the exact terms with your lender before taking any further steps. The mortgage will still need to be fully settled before the ownership of the property is transferred to the buyer.

What Happens When You Sell a House With a Mortgage?

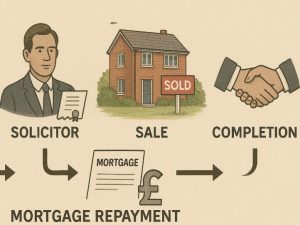

When you sell a house with an outstanding mortgage in the UK, the transaction involves repaying the remaining loan balance using the proceeds from the sale. This is a routine part of the property sales process and is handled by your solicitor during the final stage known as completion.

Once your home is under offer and a completion date is agreed, your solicitor will request a mortgage redemption statement from your lender. This statement outlines exactly how much you owe, including any interest due up to the completion date and any early repayment charges that may apply.

The buyer’s funds are transferred to your solicitor, who then uses a portion of that amount to pay off your mortgage lender. The remaining balance, if any, is your equity. This is the money left over after the mortgage has been cleared and can be used for your next purchase or retained as cash.

The key actions that happen during this process include:

- Your solicitor receiving a redemption statement from your lender

- The buyer transferring funds to your solicitor on completion day

- Your solicitor repaying the full mortgage amount directly to the lender

- Any surplus funds being released to you after deductions

It’s important to note that until the mortgage is paid in full, the property cannot legally be transferred to the buyer. This ensures the lender’s financial interest in the property is resolved before the ownership changes hands.

In cases where the sale proceeds do not fully cover the mortgage (known as negative equity), the sale becomes more complicated. You’ll either need to repay the shortfall yourself or arrange a settlement plan with your lender before the transaction can go ahead. Lenders must approve these arrangements, and not all are willing to do so.

If you are also buying a new property, your solicitor may coordinate both the sale of your current home and the purchase of the new one. In this scenario, the equity from your sold property can be used as the deposit for the new mortgage.

This entire process is structured and regulated, but timing and communication are essential. Delays in receiving redemption figures or resolving issues with the lender can slow down the sale. It’s advised to instruct a solicitor and inform your lender early in the process to avoid disruption.

What Are Your Options When Selling a Mortgaged House?

If you’re selling a property that still has a mortgage, there are usually two ways to manage it:

- Pay off the remaining mortgage from the proceeds of the sale

- Transfer the mortgage to a new home using the same lender and terms

Your decision depends on factors like the amount of equity you have, the terms of your current mortgage, and the cost or availability of new mortgage products. Mortgage lenders usually issue a redemption statement to show exactly how much needs to be paid to clear the debt at the time of sale.

How Does Porting a Mortgage Work?

Porting allows you to carry your existing mortgage to a new property, maintaining the same interest rate and repayment terms. This is useful when your current mortgage deal is better than what’s available in the current market.

When porting a mortgage:

- The outstanding loan is paid off using the proceeds from your house sale

- A new mortgage is opened on the new property with the same terms

- If the new property costs more than your current mortgage, you might need an additional loan

Lenders will reassess your financial situation and the value of the new property. Approval is not guaranteed, even if you qualified for the mortgage originally. If you’re increasing your borrowing, the extra amount may be offered at a different rate.

Porting is most beneficial for those on a fixed-rate deal that is lower than market rates or for homeowners who want to avoid early repayment charges.

Should You Port Your Mortgage or Pay It Off?

Choosing whether to port your mortgage or repay it in full depends on a few important factors. If your current mortgage has an attractive fixed interest rate and high early repayment penalties, porting could be financially beneficial.

On the other hand, repaying your mortgage completely and starting fresh can give you more flexibility, especially if you’re downsizing or want to change lenders. Here are some points to consider:

- Early repayment charges can be significant, sometimes amounting to thousands of pounds

- Porting may be limited if your lender has strict eligibility criteria

- If your new property is cheaper, you may not need the full mortgage amount, affecting your eligibility to port

How Is the Mortgage Paid Off When You Sell Your House?

The mortgage is typically settled during the legal completion of the sale. When the sale of your home completes, the buyer’s payment is transferred to your solicitor. Your solicitor then repays the remaining mortgage balance to your lender directly from the sale proceeds.

If any funds are left over after the mortgage is paid off, this is released to you and can be used toward your next home. You won’t receive the sale money directly before the mortgage is cleared.

This process ensures that the property can be legally transferred to the new owner without any claims from your lender. If you are buying and selling simultaneously, the remaining equity from your old home can be used for the deposit or purchase of the new one.

What Is the Step-by-Step Process of Selling a House With a Mortgage?

The process for selling a property with a mortgage in place involves both financial checks and legal steps. Below is a breakdown of how the process typically works.

Step-by-Step Selling Process

| Stage | Description |

| Request redemption figure | Ask your lender how much is owed on your mortgage |

| Get property valuation | Use a trusted agent or online tool to assess your home’s market value |

| Calculate equity | Subtract mortgage debt from valuation to know how much equity you hold |

| Appoint solicitor and agent | Choose professionals to handle the sale and legal paperwork |

| Accept offer | Once an offer is accepted, the legal process and contracts are drafted |

| Completion | Buyer pays your solicitor, who repays the mortgage and completes the sale |

What Should You Consider Before Selling a Mortgaged Property?

There are important financial and legal aspects to consider before deciding to sell a property with an existing mortgage. Selling may not always be in your best interest, especially if you’re in a weak equity position or facing financial challenges.

- Check for any early repayment charges on your current mortgage

- Ensure your home valuation exceeds your mortgage balance to avoid negative equity

- Account for legal, agent, and moving costs in your calculations

- Consider whether the sale proceeds will cover the mortgage and provide a deposit for your next home

If you are in mortgage shortfall, you must speak to your lender to explore your options. Selling a home for less than the mortgage amount can lead to serious financial implications, including the lender taking legal action to recover the shortfall.

What Are the Risks of Negative Equity When Selling?

Negative equity occurs when the value of your home is lower than your outstanding mortgage. Selling under these circumstances is risky because the proceeds from the sale won’t be enough to repay your lender in full.

If you are in negative equity:

- You will need to cover the difference out of pocket

- Your lender may allow a short sale, but this can affect your credit

- Some lenders may offer repayment plans or consent to delay the sale until conditions improve

Negative equity is more likely if house prices have fallen since you bought your home or if you borrowed close to 100% of the property’s value.

How Do Mortgage Payments Work During the Selling Process?

Even after you’ve accepted an offer on your home, you remain responsible for your mortgage payments until completion. The property legally remains in your name, and the mortgage is not cleared until the funds from the buyer have been used to repay it.

If you miss any payments during this period:

- It can negatively affect your credit rating

- The lender may add arrears to the repayment balance

- The sale could be delayed or fall through

To avoid complications, continue your regular mortgage payments until the sale is finalised and completion occurs.

Can the Sale of a House Affect Benefit Claims?

If you receive means-tested benefits such as Universal Credit or housing support, the lump sum received from selling your home could impact your eligibility. The capital thresholds set by the government can reduce or eliminate benefit entitlements once your savings or income exceed certain levels.

How home sale proceeds may affect benefits:

| Asset Amount | Potential Impact on Benefits |

| Under £6,000 | No impact |

| £6,000 to £16,000 | Benefits may be reduced |

| Over £16,000 | Most means-tested benefits are no longer available |

It’s recommended to get financial advice before selling if you rely on benefits, especially if you’re not immediately reinvesting in another property.

How Soon Can You Sell a House After Getting a Mortgage?

Most UK mortgage lenders follow what is commonly referred to as the six-month rule. This means you must have owned the property for at least six months before you can sell it.

The primary reason for this rule is to prevent mortgage fraud and rapid property flipping. However, some exceptions may apply, especially if the property was inherited, or the owner is relocating for valid reasons such as work or family needs.

If you’re planning to sell shortly after purchasing a property, you may encounter:

- Limited mortgage options for buyers

- Apprehension from estate agents and solicitors

- Questions about the stability or condition of the property

Make sure to review the specific policies of your mortgage lender if you plan to sell within the first year of ownership.

When Should You Seek Expert Advice Before Selling?

Professional advice is vital if your situation involves:

- High early repayment fees

- Potential negative equity

- Porting conditions that are unclear

- Benefit eligibility or tax implications

Mortgage brokers, property solicitors, and estate agents can provide clarity and help you understand your obligations and options. Making decisions without understanding the terms could result in additional costs or delays.

Conclusion

Selling a home with an outstanding mortgage is common in the UK and entirely feasible with the right planning. Whether you decide to port your mortgage or repay it in full depends on your circumstances, interest rates, and goals.

Always start by speaking with your lender and getting a clear picture of your remaining mortgage balance and sale value. From there, weigh your options, consult professionals, and move forward with confidence.

FAQs

What happens to my mortgage when I accept an offer on my house?

Your mortgage remains in effect until the sale is completed. At that point, your solicitor will use the proceeds to pay off the lender.

Do I need to inform my mortgage lender before selling?

Yes, informing your lender is necessary. They’ll provide a redemption figure and advise if porting is possible.

What is a mortgage redemption statement?

This document outlines the exact amount needed to repay your mortgage at a specific date, including any fees.

Can I sell a house with negative equity in the UK?

It’s possible, but challenging. You’ll need to cover the shortfall or arrange a payment plan with your lender.

What fees are involved in selling a house with a mortgage?

You may face early repayment charges, estate agent fees, solicitor fees, and possible porting or arrangement fees.

Will I need a solicitor to handle the mortgage during the sale?

Yes, a solicitor manages the legal side and ensures your mortgage is cleared on completion.

Can I use the equity from my house to buy a new one?

Yes. After repaying the mortgage, any leftover funds (equity) can be used as a deposit on your next property.