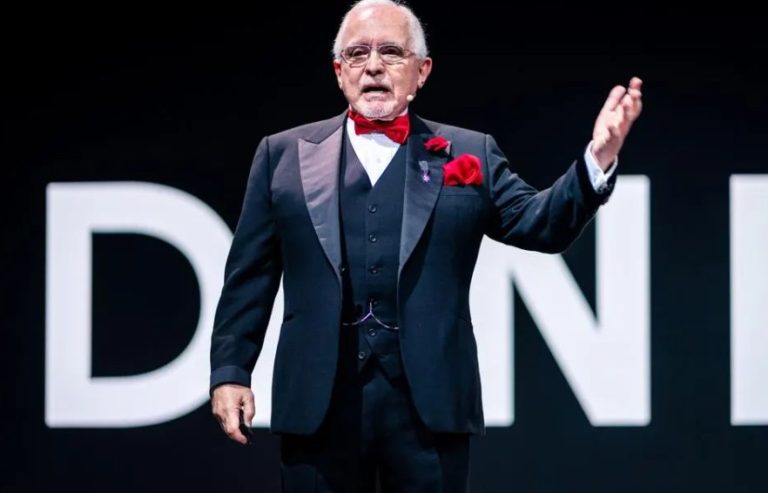

Todd Nepola has carved a respected name for himself in the competitive world of commercial real estate. As the founder of Current Capital Real Estate Group and a recurring face on The Real Housewives of Miami, he’s drawn attention not just for his television appearances but for the wealth he’s built off-screen.

With decades of experience and a deep-rooted family legacy in property development, Nepola’s financial journey offers insight into how strategic investments can lead to substantial net worth.

Who is Todd Nepola and What is His Background?

Image – Source

Todd Nepola is a third-generation real estate entrepreneur with deep family roots in the property industry. Born in 1972 and raised in a family of developers, Todd was naturally inclined towards the world of real estate from an early age.

His great-grandfather played a key role in constructing subway lines in Manhattan, while both his father and grandfather worked as real estate investors and developers.

He earned a degree from the University of South Florida between 1990 and 1994. After graduation, he spent over a decade managing commercial properties and gaining hands-on experience across various sectors of the market.

His personal life also drew public attention, particularly through his marriage to Alexia Echevarria, a cast member on The Real Housewives of Miami.

The couple tied the knot in December 2021 and later divorced in 2024. Todd has two children from a previous relationship: Sophia and Gabine Nepola.

How Did Todd Nepola Begin His Career in Real Estate?

Todd began his real estate journey by managing investment properties, which provided him with valuable insights into tenant relations, property maintenance, leasing structures and local market dynamics. His early career was built around understanding the logistics of property ownership rather than just capitalising on it.

After gaining extensive experience, Todd founded Current Capital Real Estate Group, a boutique investment firm based in Hollywood, Florida. The company specialises in acquiring, developing and managing income-generating commercial properties, primarily shopping centres and retail plazas.

Key phases in Todd Nepola’s career progression:

- Entered property management post-university

- Oversaw investment properties for over 10 years

- Launched his own firm focusing on long-term commercial investments

- Expanded his business with operations in Port St. Lucie and across Florida

What is the Estimated Net Worth of Todd Nepola in 2025?

As of 2025, Todd Nepola’s estimated net worth stands at £8.1 million (approximately $10 million USD). This valuation reflects his real estate holdings, income from rental properties, development profits and business revenue through Current Capital Real Estate Group.

While the figure is subject to market fluctuations, industry analysts consider his net worth relatively stable due to the income-producing nature of his assets.

Table: Breakdown of Todd Nepola’s Estimated Net Worth (2025)

| Asset Type | Estimated Value (GBP) | Contribution to Net Worth |

| Commercial Real Estate Portfolio | £6.3 million | Primary source |

| Business Equity (Current Capital) | £1.2 million | Operational revenue |

| Private Investments & Reserves | £400,000 | Stocks, bonds, savings |

| Personal Property & Assets | £200,000 | Vehicles, valuables |

These estimates align with external sources and publicly available information regarding his business operations and property ownership.

What are the Key Business Ventures That Built Todd Nepola’s Fortune?

Image – Source

Todd Nepola’s financial success is deeply rooted in a series of strategic business ventures, all closely tied to the commercial real estate industry. His ability to identify underperforming assets, reposition them for long-term success, and retain consistent cash flow has been a hallmark of his investment philosophy.

1. Current Capital Real Estate Group

The flagship of Todd Nepola’s business empire is Current Capital Real Estate Group, a boutique commercial real estate firm based in Hollywood, Florida.

Founded by Todd after a decade of hands-on experience in property management, the firm has grown into a respected name in the South Florida real estate market.

The company’s core services include:

- Property Acquisition: Targeting undervalued commercial properties with potential for repositioning.

- Development & Construction: Ground-up development of retail centres and small shopping complexes.

- Property Management: End-to-end asset management including leasing, tenant relations, and maintenance.

- Leasing and Brokerage: Negotiating leases with regional and national tenants to ensure occupancy and profitability.

Current Capital manages a diversified portfolio of commercial assets, many of which are situated in Florida’s emerging suburban corridors.

2. Retail-Focused Commercial Development

Unlike many real estate investors who focus on high-end residential or multifamily developments, Todd has carved out a niche in retail-focused commercial real estate. His focus is on community shopping centres and strip malls that serve as essential hubs in suburban areas.

Why this model works:

- Retail properties often come with longer lease terms, reducing turnover.

- Shopping plazas tend to attract essential service tenants, such as pharmacies, convenience stores, and fast-food outlets, ensuring consistent demand.

- These types of assets can be acquired at more favourable price points in secondary markets, offering better returns on investment.

His portfolio includes dozens of retail centres across Florida, some of which were acquired at below-market value and later repositioned through capital improvements.

3. Ground-Up Development Projects

Todd has also ventured into ground-up development, particularly in areas with growing populations but limited existing retail infrastructure. These projects involve purchasing raw land and constructing modern commercial centres tailored to local needs.

Ground-up development allows for:

- Full control over design, layout, and tenant mix

- Improved long-term asset value

- Higher rental yields due to newer facilities and attractive amenities

By controlling both the construction and leasing process, Todd maximises the return on investment and ensures the finished product aligns with long-term market demand.

4. Repositioning and Value-Add Investments

One of the most financially rewarding areas of Todd’s business model is the repositioning of ageing or underperforming retail properties.

Rather than chasing high-risk, high-reward developments, Todd prefers to identify existing assets that can be improved through renovation and rebranding.

Typical improvements might include:

- Updating façades and signage

- Resurfacing parking areas

- Enhancing landscaping and lighting

- Installing energy-efficient upgrades

- Attracting more stable, long-term tenants

These enhancements allow properties to command higher rents, increase tenant satisfaction, and ultimately appreciate in market value.

5. Strategic Tenant Relationships

A critical aspect of Todd’s long-term success has been his ability to build and maintain relationships with regional and national retail tenants.

His properties often include well-known brands such as CVS, Subway, and other franchise operations, which offer financial stability and brand recognition.

Benefits of these tenant relationships include:

- Reliable income through triple-net leases (NNN)

- Reduced property management burdens

- Higher resale value of occupied, leased centres

- Longer lease durations, often exceeding 5–10 years

His leasing strategy involves negotiating favourable terms that protect the asset’s cash flow while accommodating tenants’ growth and expansion needs.

6. Diversified Regional Presence

While based in Hollywood, Florida, Todd has intentionally expanded his business across multiple Florida counties, including Broward, Miami-Dade, and St. Lucie. This geographical diversification helps reduce market-specific risks and allows him to tap into different demographic trends.

He avoids overconcentration in one market, which is a common pitfall for smaller developers. This approach provides a cushion against regional downturns and ensures that his portfolio performs even if certain areas underdeliver temporarily.

How Has Todd Nepola’s Role in Reality TV Impacted His Public Image and Wealth?

Todd Nepola’s appearances on The Real Housewives of Miami introduced him to a broader audience. Though he is not a full-time cast member, his presence on the show as Alexia Echevarria’s husband brought attention to his business and lifestyle.

While his wealth was built independently of the show, the visibility offered through RHOM has helped raise the public profile of his company. Current Capital Real Estate Group has benefited from increased brand recognition, especially among Miami’s affluent circles.

However, this increased attention also led to scrutiny, particularly during his divorce proceedings in 2024. Financial aspects of the marriage and prenuptial agreement became topics of public discussion, which may have affected his personal privacy but did not impact his financial standing.

What Is Todd Nepola’s Investment Strategy in the South Florida Market?

Image – Source

Todd’s investment strategy centres on stability, location and undervalued assets. His approach is markedly different from speculative developers or short-term flippers. Instead, he focuses on long-term value creation and income generation.

Key elements of Todd Nepola’s investment strategy include:

- Investing in commercial properties with long-term tenants

- Targeting suburban areas experiencing demographic growth

- Renovating ageing retail spaces to meet modern consumer demand

- Diversifying across multiple counties to spread risk

- Prioritising tenant retention over frequent turnover

This conservative but consistent approach has allowed him to grow his portfolio during both booming and challenging economic cycles.

How Does Todd Nepola Compare to Other Real Estate Entrepreneurs?

While Todd may not have the public notoriety of national television property personalities, his success places him among Florida’s most respected mid-sized developers. His business model focuses on sustainability and predictable returns rather than explosive growth or brand-building.

Comparison with other industry players:

- Barbara Corcoran (Shark Tank): Specialises in residential real estate and media, with a net worth exceeding £80 million

- Grant Cardone: Focuses on multifamily residential projects and marketing, with significant media branding

- Todd Nepola: Concentrates on retail commercial development, privately held, less media-driven

Nepola’s discreet and disciplined approach has earned him a reputation for being a results-oriented investor who prioritises financial health over publicity.

What Can Aspiring Property Investors Learn from Todd Nepola?

Todd Nepola’s journey offers valuable insights for aspiring real estate investors looking to build wealth through commercial property:

- Begin with industry experience rather than speculation

- Focus on one property sector and learn it deeply

- Build a portfolio with long-term cash flow in mind

- Develop direct relationships with tenants and vendors

- Expand cautiously and avoid overleveraging assets

Rather than rapid expansion, Todd has grown his portfolio methodically, using knowledge gained through hands-on involvement. This practical, grounded approach is especially useful for new investors in the UK considering entry into the commercial real estate market.

Nepola’s Net Worth Prediction for 2026

Based on current real estate market trends, Todd Nepola’s historical growth rate, and projected commercial development in South Florida, it is reasonable to forecast a net worth increase of approximately 8% to 12% by 2026. This growth would reflect both asset appreciation and new acquisitions through his firm, Current Capital Real Estate Group.

Projected Net Worth (2026 Estimate)

| Year | Estimated Net Worth (USD) | Estimated Net Worth (GBP)* |

| 2025 | $10 million | £8.1 million |

| 2026 | $10.8 – $11.2 million | £8.7 – £9 million |

*GBP values are approximate and based on current exchange rates as of Q3 2025.

Key Factors Supporting the Growth:

- Continued Expansion of Retail Investments: Todd is actively expanding into suburban commercial corridors that are experiencing population growth, which typically drives retail demand and property values.

- Long-Term Lease Contracts: Many of Todd’s tenants are on multi-year leases with escalation clauses, which incrementally increase rent over time, boosting recurring revenue.

- Post-Divorce Asset Clarity: Following his divorce in 2024, Todd’s financial standing is expected to stabilise, with prenuptial terms likely preserving his core business and assets.

- South Florida Market Resilience: Despite broader economic fluctuations, Florida remains one of the most resilient markets for commercial real estate due to tax incentives, migration trends, and business-friendly policies.

Conservative Risk Factors

- Potential interest rate hikes in 2026 may slightly slow down the pace of acquisition or increase financing costs.

- Retail sector performance may vary depending on consumer spending patterns and inflation.

Verdict

By 2026, Todd Nepola’s net worth is likely to surpass $11 million (£9 million) if his current trajectory continues and market conditions remain stable. This growth would maintain his position as a prominent mid-sized player in the Florida commercial real estate sector.

Conclusion

Todd Nepola’s rise from managing properties to running a multi-million-pound real estate firm is a powerful example of how focused expertise, family legacy, and smart investing can lead to significant financial success.

His career is proof that building wealth through real estate doesn’t require celebrity status, just vision, discipline, and a well-executed strategy.

As the South Florida market continues to evolve, Todd’s approach remains relevant: invest wisely, manage efficiently, and never underestimate the value of location.

FAQs About Todd Nepola’s Net Worth and Real Estate Career

How did Todd Nepola become successful in real estate?

Todd’s success stems from his deep family roots in the industry, his experience in property management, and a strategic focus on commercial real estate investments in high-growth areas.

Is Todd Nepola still married to Alexia Echevarria?

No. Todd filed for divorce from Alexia in 2024 after two years of marriage. The couple had a prenuptial agreement, though its details remain confidential.

What company does Todd Nepola run?

He is the founder and president of Current Capital Real Estate Group, a Florida-based firm that specialises in commercial real estate investment and development.

Does Todd Nepola invest only in Florida properties?

Primarily, yes. His main focus is on the South Florida market, but he has indicated plans to expand to other regions with similar growth potential.

What kind of properties does Todd Nepola invest in?

Todd primarily invests in income-generating commercial properties, including shopping centres, strip malls, and office complexes.

Has Todd Nepola written any books or shared investment advice?

As of now, Todd has not published a book, but he has shared insights through interviews, podcasts, and via his company’s website.

How does Todd Nepola’s net worth compare to other reality TV personalities?

While Todd’s £10 million net worth is substantial, it is less than some reality TV stars with major brand deals. However, his wealth comes from sustainable real estate investments rather than media contracts.

Featured Image – Source