Owning a home with a mortgage in the UK comes with financial responsibilities, especially in times of hardship. Many homeowners wonder whether they can claim Housing Benefit to help with their mortgage costs.

While Housing Benefit is typically associated with renters, this blog explores what financial assistance is available to those who own their homes but are struggling to meet housing expenses.

Why Can’t Homeowners Claim Housing Benefit in the UK?

Housing Benefit is a financial support scheme aimed at people who rent their homes, either through private landlords or social housing associations. It does not apply to people who own their homes, regardless of whether they still owe a mortgage on the property.

The government makes a clear distinction between renters and homeowners. Housing Benefit is designed to assist with rent payments only, and therefore, mortgage payers are not eligible.

This policy aims to direct public funding towards housing costs that are not investment-based, as owning a property is often considered an asset.

However, recognising that homeowners may also face financial hardship, the government has introduced other support options tailored for those with mortgage commitments.

What Is Support for Mortgage Interest (SMI) and How Does It Work?

Support for Mortgage Interest (SMI) is the main alternative available for homeowners. It is designed to assist with the interest portion of a mortgage rather than the total repayment amount.

SMI is offered as a loan and is payable only while the claimant is receiving certain income-based benefits.

This support is not automatic and does not cover all housing-related costs. SMI is intended to prevent homeowners from losing their property while they are experiencing financial hardship due to low income or unemployment.

Who Is Eligible for SMI in the UK?

Eligibility for SMI depends on the claimant receiving one of the following qualifying benefits:

- Universal Credit (for at least 3 consecutive months)

- Income Support

- Income-based Jobseeker’s Allowance (JSA)

- Income-related Employment and Support Allowance (ESA)

- Pension Credit

In addition to receiving a qualifying benefit, you must also be the legal owner of the property and live in it as your main residence.

What Type of Mortgage Payments Does SMI Cover?

The SMI loan only covers the interest on:

- Standard residential mortgage loans

- Loans taken out for necessary home improvements or essential repairs

It does not help with:

- Capital repayments

- Insurance premiums

- Arrears or late fees

This limitation means SMI will only assist with a portion of the overall monthly mortgage payment, which could still leave homeowners responsible for a significant balance.

How Is the SMI Loan Paid and Repaid?

The SMI loan is paid directly to your mortgage lender. It is not handed over to you, ensuring that the funds are used strictly for their intended purpose.

The loan must be repaid with interest when:

- The property is sold

- Ownership is transferred

- The borrower dies and the estate is settled

Interest on the loan is applied at a fixed rate set by the government. Repayment is only required if there is enough equity in the home after the event that triggers repayment.

Can You Get Help With Housing Costs Through Universal Credit?

Although homeowners are not eligible for Housing Benefit, they may receive help with housing costs through Universal Credit. However, this help is not for mortgage repayments, but instead for associated costs such as service charges.

This support is part of the housing costs element of Universal Credit and applies to those who meet strict criteria.

What Housing Costs Can Universal Credit Cover for Homeowners?

To qualify for support under Universal Credit, all of the following conditions must apply:

- You are eligible for Universal Credit

- You or your partner own and live in the home

- The property is leasehold

- You are responsible for paying service charges

This type of support is intended to help leaseholders manage the ongoing expenses required for maintaining communal areas and shared facilities.

How Do Service Charges Factor Into Universal Credit?

Service charges must be necessary and reasonable. Universal Credit will only consider the costs that directly contribute to the basic maintenance and operation of the property. These may include:

- Rubbish collection

- Communal lift servicing

- Window cleaning (upper floors)

- Lighting and heating in shared spaces

- Routine repairs and upkeep

The assessment is made based on the documents you submit when claiming Universal Credit, such as your lease or service charge statements.

What Are the Conditions to Qualify for Help With Service Charges?

You must have been receiving Universal Credit for at least nine months before you can be eligible for service charge support.

Service charges will not be supported if your income includes any of the following:

- Employment wages (whether employed or self-employed)

- Refunds from HMRC

- Statutory Sick Pay

- Statutory Maternity, Paternity, or Adoption Pay

- Shared Parental Pay

This is because these income streams indicate that you may not meet the financial hardship criteria for this particular element of Universal Credit.

What Counts as a Service Charge?

To qualify under Universal Credit, the service charge must be related to communal maintenance or property upkeep. Examples include:

- Maintenance of hallways, stairwells, and shared gardens

- Cleaning and upkeep of bins and waste areas

- Building insurance premiums (if part of lease obligations)

- Repairs to roofs or shared walls

It is essential that the charges are stated clearly in the lease agreement or supported by written evidence from the property manager.

How Does Owning a Home Affect Your Benefit Entitlement?

Owning a home can limit your eligibility for certain benefits, particularly those targeted at renters. However, it does not entirely exclude you from receiving help.

The financial help available to homeowners is often more restrictive and conditional. For example, while renters may be able to claim Housing Benefit, homeowners must rely on SMI and Universal Credit elements, both of which come with strict eligibility rules and timelines.

Can You Claim Any Other Government Help for Mortgage Payments?

Beyond SMI, there are few direct government schemes to help with mortgage repayments. However, homeowners might be able to access additional financial support through:

- Council tax reductions

- Budgeting advances from Universal Credit

- Cold Weather Payments or Winter Fuel Payments (if applicable)

- Local Welfare Assistance Schemes (administered by local councils)

These forms of support do not contribute directly to your mortgage but may help with your overall cost of living.

Is There Financial Support for Homeowners on a Low Income?

Yes, although limited, financial assistance options include:

- Universal Credit housing cost element for leaseholders

- Pension Credit (which can make you eligible for SMI on loans up to £100,000)

- Local authority support schemes

- Debt advice and management plans through Citizens Advice or StepChange

Eligibility for these programmes depends on income, savings, and other personal circumstances.

What Are the Key Differences Between Housing Benefit and SMI?

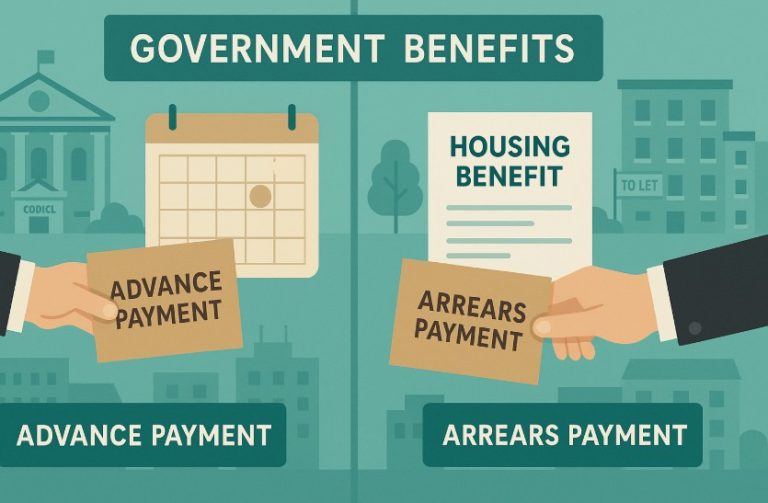

Housing Benefit and Support for Mortgage Interest (SMI) are two distinct government support schemes in the UK, each designed for different circumstances. Understanding the key differences between the two can help homeowners and renters identify the appropriate type of support for their situation.

Housing Benefit is a long-established financial assistance programme aimed at helping renters meet their housing costs.

It is a non-repayable benefit, meaning that eligible individuals receive it as direct financial support to reduce their rent burden. The benefit is either paid to the tenant or, in many cases, directly to the landlord.

In contrast, Support for Mortgage Interest (SMI) is designed specifically for homeowners who are struggling to keep up with mortgage interest payments.

Unlike Housing Benefit, SMI is not a grant or regular benefit it is a loan that must be repaid when the property is sold or transferred, subject to the availability of equity in the home.

SMI is only available to people who are already receiving certain income-based benefits such as Universal Credit, Income Support, or Pension Credit.

The scope of coverage also varies significantly. Housing Benefit can potentially cover the full rent or a substantial portion of it, depending on income, household size, and rental costs in your area.

On the other hand, SMI only covers the interest portion of your mortgage (not the capital repayments), and this is calculated using a standardised interest rate set by the government, not the actual rate on your mortgage.

Moreover, while Housing Benefit does not need to be repaid, the SMI loan accrues interest over time and is recoverable upon sale or transfer of the property.

This makes SMI a temporary form of support to protect homeowners from repossession during periods of financial hardship, rather than a permanent solution.

Here’s a detailed comparison:

| Category | Housing Benefit | Support for Mortgage Interest (SMI) |

| Target Group | Private or social housing tenants | Homeowners with mortgages |

| Nature of Support | Non-repayable benefit | Repayable loan with interest |

| What It Covers | Rent payments | Interest on mortgage and qualifying home improvement loans |

| Payment Method | Paid to tenant or directly to landlord | Paid directly to mortgage lender |

| Eligibility | Based on income and rental situation | Must receive qualifying benefits |

| Repayment Required | No | Yes, when property is sold or transferred |

| Duration of Support | Ongoing while eligible | Starts after a waiting period and continues while on benefits |

| Additional Costs Covered | May include service charges and Council Tax | Does not cover capital repayments, insurance, or arrears |

Understanding these differences is crucial because applying for the wrong type of support can lead to delays or denials in receiving help.

Renters should focus on Housing Benefit or the housing costs element of Universal Credit, while homeowners must explore SMI and related options.

What Housing Costs Can Universal Credit Cover for Homeowners?

Universal Credit includes a housing costs element that can offer financial support to homeowners under specific conditions.

Although this support does not cover mortgage capital repayments, it can help with service charges related to leasehold properties, offering some relief for those struggling with ongoing housing costs.

To receive housing cost support through Universal Credit, the claimant must:

- Be eligible for Universal Credit

- Own the property (either solely or jointly with a partner)

- Live in the property as their main residence

- Have leasehold obligations that include eligible service charges

The service charges covered by Universal Credit must be deemed “necessary and reasonable” by the Department for Work and Pensions (DWP). This means the charges must directly relate to the upkeep, maintenance, and management of the property or shared areas.

Examples of Eligible Housing Costs Under Universal Credit

- Maintenance and repair of communal areas

- Lighting and heating of shared spaces (e.g., hallways, lifts)

- Cleaning services for common areas

- Window cleaning for upper-floor flats

- Refuse collection (communal bins)

- Upkeep of shared gardens or facilities

These costs must typically be supported by documentation such as lease agreements or service charge statements.

You must have been receiving Universal Credit for at least nine consecutive months before support for these charges becomes applicable.

What Is Not Covered Under Universal Credit for Homeowners?

While Universal Credit does provide some help with housing costs for homeowners, it does not cover:

- Mortgage repayments (capital or interest)

- Mortgage arrears

- Property insurance

- Structural repairs not covered under service charges

- Costs not explicitly required by the lease agreement

In these cases, homeowners must rely on Support for Mortgage Interest (SMI) to cover interest payments, or seek other forms of financial aid such as budgeting loans or local authority schemes.

Universal Credit Housing Support for Homeowners:

| Type of Housing Cost | Covered by Universal Credit? | Conditions Apply? |

| Mortgage capital repayments | No | Not eligible |

| Mortgage interest | No | Use SMI instead |

| Service charges (communal upkeep) | Yes | Must be leasehold and reasonable |

| Cleaning shared spaces | Yes | Included in lease terms |

| Lighting and heating shared areas | Yes | Part of communal facilities |

| Insurance or arrears | No | Not considered eligible costs |

| Ground rent | Rarely | May apply under certain leases |

This housing cost support under Universal Credit is particularly helpful for those living in flats, maisonettes, or shared ownership properties where service charges are standard.

It’s important to regularly review your benefit entitlements and notify the DWP of any changes to your property status or service charge arrangements to maintain accurate support.

Final Thoughts

While you cannot claim Housing Benefit if you own your home and pay a mortgage, there are still avenues for support. Support for Mortgage Interest (SMI) and Universal Credit housing costs are designed to help eligible homeowners cover essential housing-related expenses.

Though these schemes come with conditions — such as waiting periods, repayments, or income limits — they offer much-needed relief to those facing financial strain.

If you’re struggling to keep up with your housing costs, contact your local Jobcentre or Citizens Advice to explore your eligibility for these schemes.

Frequently Asked Questions

Can I get Housing Benefit if I’m a shared ownership homeowner?

No. However, if you’re on Universal Credit and live in a shared ownership property, you may be able to get help with service charges through the housing cost element.

How long must I be on Universal Credit to get SMI?

You must be receiving Universal Credit for at least three consecutive months before you’re eligible for Support for Mortgage Interest.

Does SMI cover arrears or just current interest payments?

SMI only covers current interest payments, not any outstanding arrears or the principal balance on your mortgage.

Will I lose my SMI loan if I go back to work?

If your Universal Credit or qualifying benefit stops due to employment, SMI payments will also stop. However, the loan amount already paid remains repayable upon sale or transfer of the property.

Can pensioners receive help with mortgage interest?

Yes. Pensioners who receive Pension Credit can qualify for SMI, and they may be eligible for assistance with mortgage interest up to £100,000.

Are there any grants available instead of loans for mortgage help?

No grants currently exist for mortgage interest support. SMI is structured as a repayable loan, not a grant.

How do service charges get verified for Universal Credit?

You must provide evidence of service charges (e.g., lease agreements, bills, or statements) to the DWP when applying for Universal Credit.