Stamp Duty Land Tax (SDLT) is a major cost consideration when purchasing property in the UK, yet many buyers are unsure whether it can be included in their mortgage.

With housing costs rising and upfront fees often substantial, understanding how lenders treat stamp duty is vital. This guide explores whether stamp duty can be added to a mortgage, who pays it, how it’s calculated, and what options are available for those needing help with this significant expense.

What is Stamp Duty Land Tax (SDLT) and Why Is It Important?

Stamp Duty Land Tax, commonly referred to as SDLT, is a government levy applied to property and land purchases in England and Northern Ireland.

It becomes payable when the purchase price exceeds a certain threshold. SDLT is administered by HMRC and is paid by the purchaser within 14 days of the transaction completion.

This tax generates billions in revenue for the UK government and contributes to public services, infrastructure, and housing initiatives. It also plays a role in regulating the property market by curbing excessive investment in second homes and buy-to-let properties.

As a result, SDLT can help balance market demand and make homeownership more accessible, especially for first-time buyers.

Who Has to Pay Stamp Duty in the UK?

Any individual or organisation purchasing property in England or Northern Ireland is required to pay SDLT if the property value exceeds £250,000.

The buyer is responsible for submitting an SDLT return and ensuring payment is made on time. Solicitors often handle this process on behalf of the buyer.

Different property tax regimes apply in Scotland and Wales. In Scotland, the equivalent tax is the Land and Buildings Transaction Tax (LBTT), while in Wales it is the Land Transaction Tax (LTT). Each has distinct thresholds and rates.

In addition to residential property, SDLT also applies to some leasehold transactions, land purchases, and commercial properties, depending on their value and use.

Are There Any Reliefs or Exemptions from Stamp Duty?

There are multiple reliefs and exemptions designed to reduce the financial burden of stamp duty, especially for specific types of buyers or property scenarios. The most common include:

- First-time buyer relief

- Property value exemptions

- Transfers due to separation or inheritance

- Certain leasehold purchases

Buyers who qualify for first-time buyer relief will pay no stamp duty on homes valued up to £425,000. For properties valued between £425,001 and £625,000, a 5% charge applies to the portion above £425,000.

Stamp duty is not applicable in cases where:

- The property value is less than £250,000 and is the buyer’s only home

- The property is inherited through a will

- Ownership is transferred due to divorce or dissolution of a civil partnership

- A freehold property is purchased for under £40,000

- A leasehold property is bought with a premium below £40,000 and annual rent under £1,000

These reliefs can significantly reduce or even eliminate stamp duty liability for eligible buyers.

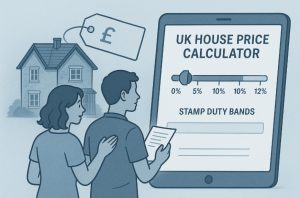

How Is Stamp Duty Calculated on Property Purchases?

Stamp duty is calculated on a tiered system where different segments of the property’s purchase price are taxed at escalating rates. This progressive tax system ensures that higher-value properties attract higher taxes.

Below is a table summarising the standard SDLT rates as of May 2024:

| Property Price Range | SDLT Rate (Standard Buyer) |

| Up to £250,000 | 0% |

| £250,001 to £925,000 | 5% |

| £925,001 to £1.5 million | 10% |

| Above £1.5 million | 12% |

For first-time buyers:

- No SDLT is payable on homes priced up to £425,000

- A 5% SDLT is applied only to the amount above £425,000 for homes up to £625,000

- Properties above £625,000 do not qualify for first-time buyer relief

Additional surcharges apply in the following scenarios:

- A 3% surcharge for second homes or buy-to-let investments

- A 2% surcharge for non-UK residents who have spent fewer than 183 days in the UK in the previous 12 months

Stamp duty calculators are widely available and help buyers estimate their tax obligations accurately.

Can a Mortgage Cover Stamp Duty Costs in the UK?

In the past, some lenders offered combined mortgage products that included an additional unsecured loan to cover purchase costs like stamp duty and legal fees.

These products occasionally reached up to 125% of the property’s value. However, such high-risk lending practices led to a spike in negative equity following the 2008 financial crisis and were largely discontinued.

Currently, standard mortgage products in the UK do not cover stamp duty. Most lenders require buyers to pay SDLT from their personal funds, and only the arrangement fees or valuation costs may be added to the mortgage under strict conditions.

There are a few exceptions where lenders might agree to increase the loan amount to indirectly cover stamp duty, but this is rare and depends heavily on affordability assessments, LTV ratios, and credit history.

These options are usually discussed in detail with a mortgage broker or financial advisor during the application process.

What Are the Pros and Cons of Adding Stamp Duty to a Mortgage?

In cases where lenders permit increased borrowing that covers stamp duty, it is essential to weigh the benefits against the potential financial impact.

Advantages of including stamp duty in the mortgage:

- May enable buyers to complete the purchase without requiring immediate cash reserves

- Offers flexibility for those with high incomes but limited savings

Disadvantages to consider:

- Higher total loan amount results in more interest paid over time

- Monthly repayments will increase, affecting affordability

- Could impact your loan-to-value ratio, possibly leading to higher mortgage rates or reduced product options

- Mortgage approval could be affected due to increased overall borrowing

The following table outlines a simplified example:

| Scenario | Without SDLT in Mortgage | With SDLT in Mortgage |

| Property Price | £400,000 | £400,000 |

| SDLT Amount | £7,500 | £7,500 |

| Mortgage Loan | £350,000 | £357,500 |

| Monthly Payment (approximate) | £1,650 | £1,690 |

| Total Interest Over 25 Years | £145,000 | £149,500 |

Even though the monthly increase appears modest, over time the additional interest can be substantial.

What Alternatives Are Available if You Can’t Add Stamp Duty to a Mortgage?

Since the majority of UK mortgage lenders do not allow borrowers to roll stamp duty into their loan amount, prospective homebuyers must consider alternative methods to cover this significant upfront cost.

Stamp Duty Land Tax (SDLT) can amount to thousands of pounds depending on the property’s value, and failing to budget for it can jeopardise a transaction. Fortunately, several practical alternatives exist for funding stamp duty outside of your mortgage.

1. Use Personal Savings

The most straightforward and financially prudent option is to pay stamp duty from personal savings. This approach avoids additional borrowing, interest payments, or affordability complications.

- It keeps your loan-to-value (LTV) ratio low, which could help you qualify for better mortgage deals

- There’s no interest incurred on stamp duty when paid upfront from savings

- It demonstrates financial preparedness to lenders, strengthening your mortgage application

However, it requires that you’ve saved enough in addition to your deposit and other home-buying costs, which may not always be feasible, particularly for first-time buyers or those in high-cost areas.

2. Adjust Your Deposit Contribution

Another common method is to reallocate part of your deposit to cover stamp duty. For example, if you originally planned to put down a 15% deposit, you might reduce it to 10% and use the difference for SDLT.

While this makes funds available to pay the tax, it does come with trade-offs:

- Reducing your deposit increases your LTV ratio, which may result in:

- Higher mortgage interest rates

- Fewer product choices

- Additional lender requirements, such as higher credit scores

- A higher LTV may also affect your monthly mortgage repayments

This option might be suitable for buyers with flexible financial plans who are not at the threshold of their borrowing capacity.

3. Borrowing Through a Personal Loan

If savings or deposit adjustments are not an option, a personal loan can be used to fund the stamp duty payment. This can be a viable solution in specific cases, such as:

- When you have a strong credit profile and can secure a low-interest personal loan

- If your mortgage lender permits additional financial commitments without rejecting your application

- You need a quick funding solution to secure a property

Still, this option carries notable financial consequences:

- The personal loan repayment will count toward your monthly debt obligations and affect your mortgage affordability assessment

- Taking out additional credit just before or during a mortgage application can reduce your credit score

- Over-borrowing can increase financial stress in the early years of homeownership

Lenders will typically review all debts, including unsecured personal loans, when deciding on your mortgage eligibility.

4. Seek Help from Family or Friends

Another practical alternative is to seek assistance from relatives or friends, either in the form of a financial gift or a loan. A gifted deposit or SDLT contribution from a family member can help bridge the funding gap without needing to reduce your deposit or borrow more.

Important points to consider:

- Lenders usually require a declaration stating that the money is a gift and not repayable

- Proof of funds and the identity of the gifter will be required to comply with anti-money laundering regulations

- Loans from family may need to be disclosed to the lender and could affect affordability

While this option can ease financial pressure, it should be based on clear agreements to prevent future misunderstandings.

5. Explore Different Lenders Through a Mortgage Broker

Not all lenders treat affordability and borrowing limits in the same way. Some may offer more flexible underwriting, especially if you’re in a strong financial position. A mortgage broker has access to a wide panel of lenders, including niche and specialist providers who may be more accommodating.

Using a broker can help:

- Identify lenders who offer higher loan-to-income (LTI) ratios

- Match your personal financial profile with a suitable product

- Save time and effort in researching lender policies individually

This option is especially valuable for buyers with non-standard income (e.g., self-employed, freelancers) or complex financial histories.

6. Delay the Property Purchase

Though less appealing, waiting to purchase a property until you’ve saved enough to cover the full stamp duty and associated fees is sometimes the most responsible option. Rushing into a purchase without the necessary funds can result in financial strain, risky borrowing, or failed transactions.

Delaying allows you to:

- Continue saving towards SDLT and other costs without compromising your financial stability

- Improve your credit score or increase your deposit over time

- Monitor the housing market for more favourable conditions or price adjustments

This approach prioritises long-term stability over short-term convenience and is often recommended for buyers who are stretching their finances to reach the property ladder.

7. Government Schemes (Limited Relevance for SDLT)

Although there are several government-backed schemes to help with deposits and mortgage accessibility, such as the Lifetime ISA or Shared Ownership, they do not cover stamp duty directly. However, first-time buyers can benefit from SDLT relief schemes that reduce or eliminate the amount owed, depending on the property’s value.

For example:

- First-time buyers purchasing a home worth up to £425,000 pay no stamp duty

- If the purchase price is between £425,001 and £625,000, SDLT applies only to the amount above £425,000 at a rate of 5%

These reliefs, while not an alternative funding source, can significantly reduce the burden of SDLT and may make it more manageable without additional borrowing.

| Alternative | Pros | Cons |

| Use Personal Savings | No extra debt, keeps LTV low | Requires larger savings upfront |

| Adjust Deposit Contribution | Access funds easily | May result in higher LTV and interest rates |

| Personal Loan | Quick funding solution | Affects affordability, incurs interest |

| Family Gift or Loan | Reduces need for credit | May require legal/financial declarations |

| Mortgage Broker Assistance | Tailored lender recommendations | Broker fees may apply in some cases |

| Delay Purchase | Increases savings and financial stability | Could miss current property or favourable rates |

Each of these options should be considered carefully and in context with personal financial goals and circumstances. Engaging a mortgage advisor early in the buying journey can help determine which route is most viable without jeopardising long-term affordability.

How Can You Plan Ahead for Stamp Duty Costs Effectively?

One of the most effective ways to manage stamp duty is to integrate it into your initial property budgeting process. Buyers who overlook this cost may face delays or risk losing a property if the funds are not available upon completion.

Planning strategies include:

- Using the official HMRC stamp duty calculator to determine the expected tax bill before making an offer

- Building SDLT into the total savings target alongside the deposit and legal fees

- Consulting a mortgage advisor early in the process to understand how SDLT may affect affordability and loan eligibility

- Keeping up-to-date with government SDLT thresholds and relief updates

By taking these steps early in the property search, buyers can avoid last-minute financial surprises and proceed with greater confidence.

Should You Consult a Mortgage Broker or Financial Advisor?

Given the complexities around SDLT and mortgage affordability, seeking guidance from professionals is often beneficial. Mortgage brokers have access to a wider range of lenders and can identify which ones may offer increased borrowing allowances. They also understand how lenders assess affordability, income stability, and creditworthiness.

Financial advisors can assist in evaluating the long-term impact of higher borrowing, especially if SDLT or additional costs are financed through credit. They can help buyers align their property purchase with broader financial planning, including pension contributions, emergency savings, and other investments.

Choosing to work with a professional can be especially valuable for buyers with complex financial situations, such as the self-employed, those with irregular income, or buyers considering joint mortgages.

Conclusion: Is Adding Stamp Duty to a Mortgage a Wise Decision?

In most cases, adding stamp duty to a mortgage is not an available or advisable option. While a few lenders may offer flexibility, the added debt burden, higher repayments, and interest costs typically outweigh the convenience. Buyers are strongly advised to budget separately for stamp duty and explore all reliefs and exemptions before committing to a purchase.

Careful planning, sound financial advice, and a realistic assessment of affordability can ensure that this significant tax does not derail your property buying journey.

FAQs About Adding Stamp Duty to a Mortgage in the UK

Is stamp duty ever included in the mortgage by default?

No, lenders in the UK do not automatically include stamp duty in a mortgage. It must be paid separately unless explicitly agreed.

Can first-time buyers add stamp duty to their mortgage?

While they may receive relief, if any SDLT is owed, most lenders require it to be paid upfront rather than added to the loan.

Will adding SDLT to a mortgage affect my interest rate?

Yes, because increasing your mortgage affects the LTV ratio, potentially leading to higher interest rates.

Are there lenders who offer stamp duty-inclusive mortgage options?

A small number of specialist lenders may consider it under strict affordability criteria, but this is not standard.

What happens if I can’t afford the stamp duty at completion?

You may risk the purchase falling through. It’s essential to ensure these funds are available or arranged in advance.

Can a personal loan be used for stamp duty?

Yes, but lenders may include this in your affordability assessment, which can impact mortgage approval.

Does stamp duty apply to leasehold properties?

Yes, SDLT applies to both freehold and leasehold properties, though different thresholds may apply based on the lease premium.

1. Heading: Can You Add Stamp Duty to Mortgage in the UK?

Prompt:

A wide-angle illustration of a UK suburban house with a price tag and a “mortgage application” document overlayed with a red “Stamp Duty?” stamp. Include a confused homebuyer silhouette in business attire reviewing documents, with the Union Jack subtly in the background. Professional, editorial style, muted tones.

2. Heading: What is Stamp Duty Land Tax (SDLT) and Why Is It Important?

Prompt:

An illustrated tax document titled “Stamp Duty Land Tax (SDLT)” next to a miniature model of a British-style detached house. Include stacks of coins and a magnifying glass over the document. Background shows the HMRC building or UK government emblem. Editorial infographic style, wide format.

3. Heading: How Is Stamp Duty Calculated on Property Purchases?

Prompt:

A digital-style UK house price calculator interface on a tablet screen with a sliding scale showing stamp duty bands (0%, 5%, 10%, 12%). Include a house and price tag in the background with a couple in casual clothing reviewing the screen. Wide format, clean and professional illustration.

4. Heading: What Alternatives Are Available if You Can’t Add Stamp Duty to a Mortgage?

Prompt:

A homebuyer standing at a crossroads labeled “Savings”, “Deposit”, “Loan”, and “Delay Purchase”, with signposts pointing in different directions. A UK house is visible in the distance. Include a pound sterling symbol in the sky like a cloud. Flat, modern illustrative style, wide layout.

5. Heading: Should You Consult a Mortgage Broker or Financial Advisor?

Prompt:

A homebuyer sitting at a desk with a mortgage broker on one side and a financial advisor on the other, each showing charts and documents. Behind them is a large UK-style home image on a screen. Include a notepad titled “Stamp Duty Options”. Professional, warm-toned illustration, wide aspect ratio.